How is the van pricing market and what should van retailers pricing strategy be?

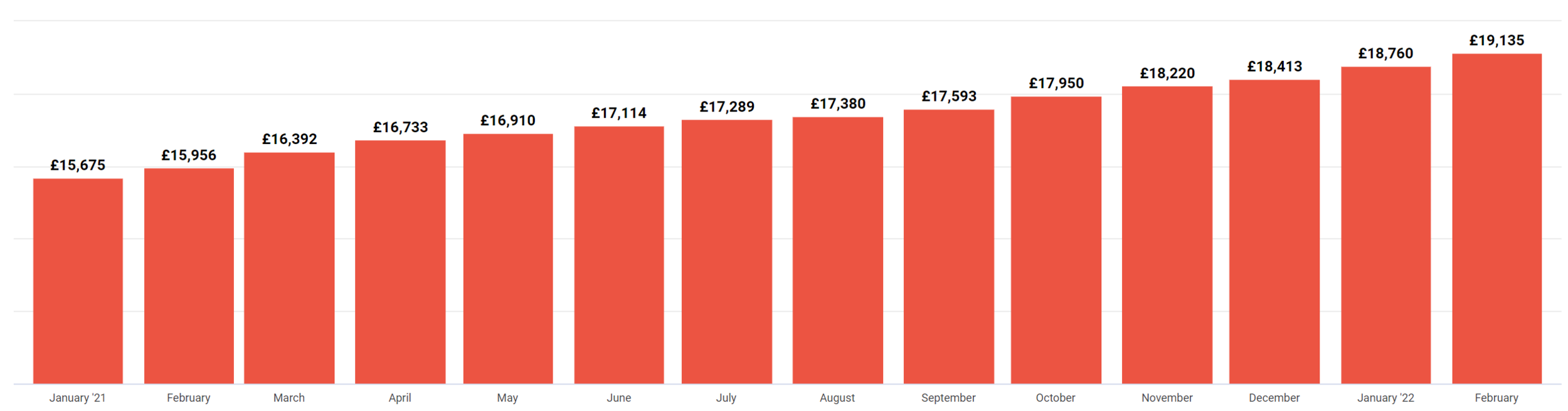

Pricing behaviors have changed a lot since the start of the pandemic with prices of vans seeing unprecedented change over the last two years. As we are now 2 months into 2022, you might be wondering what pricing behaviours we’re observing currently and what you could expect as the year progresses.

In February, we saw the average prices of vans rise yet again, by £375 compared to January, now up to over £19,000- It was the 26th consecutive month of year-on-year average price growth.

How can retailers stay on top of these rapid price changes?

At a time when the industry is evolving, and market is ever-changing, complementing your knowledge with data and insight, monitoring the market and being aware of how consumers are responding has become the key to success. Adapting to new ways of working, retailing and selling has become critical, and being aware of key trends in the van market could give you the extra edge.

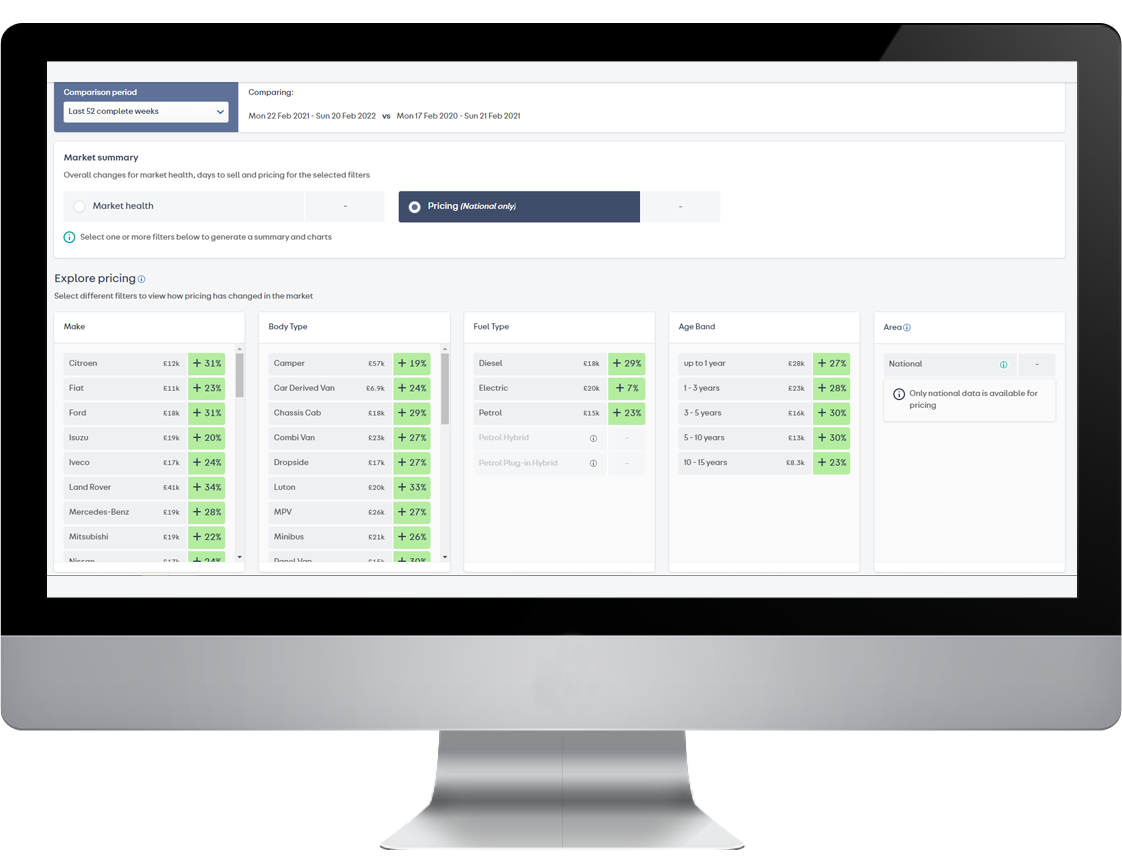

In 2020, we launched our latest market intelligence tool, AT Market Insight providing you with a detailed view of the balance of van supply and buyer demand through our market health score.

We have now added a powerful new feature allowing you to monitor the average advertised prices for any brand, model, body type, fuel type and age band to see how they’ve trended weekly compared to last year.

National pricing trends enable you to see the impact of market conditions on the pricing of vans on Auto Trader. This will be crucial in understanding whether the price of vehicles is affected by anything happening in the market.

So, what does this insight tell us about pricing today?

Using the Explore Pricing tab at the top of the page, and filtering to the last 52 complete weeks (comparing Mon 22 Feb 2021 - Sun 20 Feb 2022 vs Mon 17 Feb 2020 - Sun 21 Feb 2021), we can see that every single Make, Body Type, Petrol Type and Age Band is significant up vs the previous year.

The filter options allow you to explore particular makes & models, body types or fuel types even further. In the last year, we've seen particular growth in Land Rover, Citroen, Ford, Peugeot and Mercedes-Benz models.

Using this powerful intelligence will help you to make more informed decisions on pricing for your current forecourt and future stock mix - and to tap into a new level of opportunities to retain and grow margins.

Access this directly in portal, just head to “Analytics” in the navigation and select “Market Insight” to help remove uncertainty with this unparalleled market insight.

In summary...

Auto Trader customers have access to our AT Retail Valuations in Portal and now, the powerful pricing data in Market Insight – these should be used to base decisions on data rather than following gut instinct, now more than ever. While the retail valuations can guide you on how to price a particular vehicle, the Market Insight data can be used to compliment this by providing you with an insight into wider trends to compare vehicles over a particular time period and help you to plan ahead.

The worst thing you as a retailer could do is act too quickly or not strategically enough with how you apply price changes to your stock. We advise you to consider your pricing approach carefully and use these tools to make sure you’re following the market and not reducing unnecessarily and even point to vehicles you should be increasing.

Keeping your finger on the pulse and being aware of key trends in the van market will give you the extra edge and could be key to your business’ success.

To learn more about Market Insight and how to use it, watch the Retailer Performance Masterclass series, under “Understanding Data” here.