The Road Ahead for Automotive Retail: The view from America

Where are brand standards going?

Let’s talk about brand standards, specifically in the area of facilities standards. Every OEM wants to have lovely stores, but few OEMs ever explain to retailers what the return on investment in facilities might be. So way back in 2013, I did a project for NADA on what we call facilities (buildings, furniture, fixtures, equipment, et cetera), specifically on programs sent down from OEM headquarters in, say, Stuttgart or Nagoya, to retailers. We realised that no one had ever really looked at whether these standards paid off in any kind of ROI way.

We did an extensive amount of work where we found that expanding facilities generally had a positive ROI, as in if you can add a few service stalls and build them, you'll make money on them. Modernisation was sort of break-even but of course this is “table stakes:” you do have to have indoor plumbing and uh, you know, replace the linoleum floor with tile etc. Where we saw returns moving deeply into the red was in standardisation: it was a dead weight lost. This is the thing that the OEMs are the most excited about: How can we make every dealership look the same?

Standardisation was a deadweight loss in that the customer saw no value at all, particularly if Acme's dealership in Sheffield looked the same as Acme's dealership in St Ives. I think it's important to say that the digital storefront is the most essential to standardise, but that costs almost nothing.

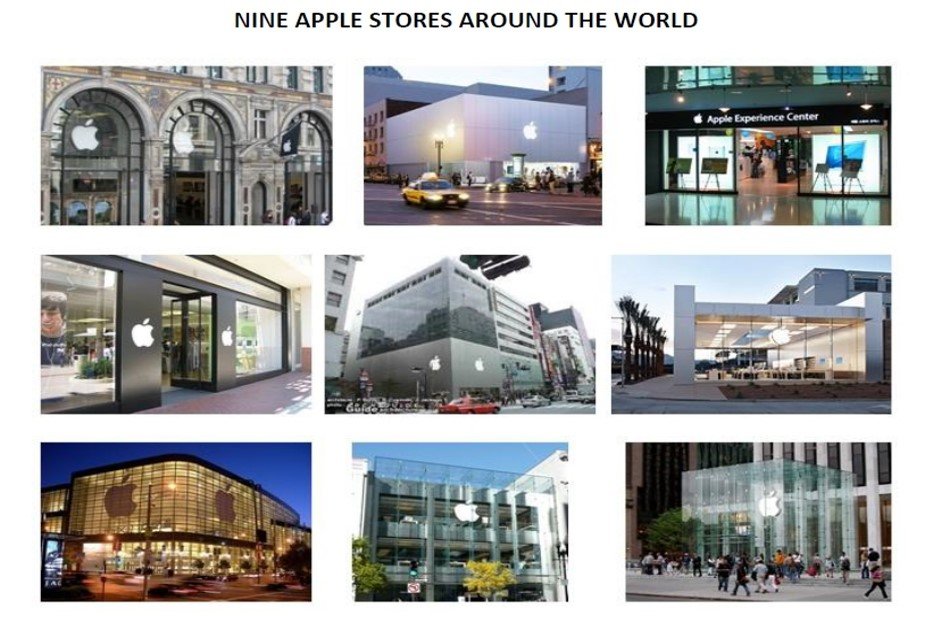

One thing to note on standardisation: OEMs, at least in the United States, tend to get excited about other successful companies they think they should try and emulate. For example, Dell’s build to order, or, more recently, Tesla for its customer interface. And a few years ago, of course, it was Apple. Somehow the Apple Store was the gold standard for retailing. We heard repeatedly in boardrooms that a huge factor in Apple’s success was the standardisation of its facilities.

I personally took nine photos of Apple Stores around the world, and I defy you to identify any standard look other than the logo itself. So, again, it really illustrates the point about whether standardisation is actually worth the money that OEMs require.

Where do we end up in 2024 and beyond?

Of course, everybody's talking about electric vehicles right now. It is a huge issue, but I would step back a bit and say the issue for dealer profitability in the United States right now is how fast we get to a new normal, how fast we regress to the mean. The average store of the public dealership chains like Lithia and AutoNation was achieving around $2 million a year in pre-tax profit per store in 2019. Then over the course of the last few years, during the chip shortages and pandemic pressures, that tripled, to around $6 million.

If you're a cynic and you've been around the industry a long time, you think we’ll naturally revert right back to where we were. If you're happier or think that OEMs will have more pricing discipline, we hope to stay at about $5 million, which would be more than double where we were. I rather hope we can get to 150%, maybe $3 million: that we've learned enough of a lesson to maintain discipline… but we are going to have to give back and already started giving back vast amounts of profit that we saw during the pandemic.

Now, about EVs: the only thing that outnumbers EVs in the USA is how many white papers, reports and articles that have been written about them. So, there's more coverage on this than you need to hear. I will just focus on a couple of things. First, the American view on this is we started with just one small niche of EVs: mostly Nissan, selling short-range urban cars. And the idea was each year, do a little bit more range and work your way up. Tesla showed up and said, “no, we'll come in at the high end with very long-range, high-end, expensive, fast cars and upset the apple cart.” Disruption was supposed to be bottom up, but they came in and did top down!

I think this is one of the reasons we're seeing the problems in the EV market: we have overloaded that premium/luxury segment. The Tesla segment: premium, we'd call sedans, you'd call saloons, loaded up with everybody pursuing Tesla. And now we realise, well, maybe we needed some of those less expensive EVs which you have in Europe.

We're sort of emerging from that today, racing to build cheap EVs. And we se the same thing you're facing: with a supply push from governments and maybe some demand-pull from fleets, but increasingly retail buyers are sitting on their hands, and where does that end up?

The long-term trajectory is up as it is almost everywhere in the world, but near term we’ve stumbled. I think one way to summarise all of this, is we've moved from a market where EVs are bought to where they are sold; from where people line up to get them to where people like yourselves, retailers, have to solve the OEM problem and get these things sold.

Where are we in our market share?

The EV market has shot up but has now stabilised, with some figures even showing it declining. I think that's a temporary blip. You know all the reasons why EVs are not accepted: price, charging infrastructure, politics, etc. But I think it comes down to, once again, the same answer as the last 125 years: product. It's the wrong product right now in the United States. We're in love with small or medium-sized trucks and crossovers, and we need those electrified before the market really uncorks. You can see this, if you look at Tesla over a period of one year. Tesla cut its average transaction price $27,000 and barely moved its market share: that tells you no amount of price cutting would move the needle farther than that. That tells me it's a product issue. Of course, OEMs now are producing products to resolve that issue.

But again, we will follow the rest of the world long term. America might have been a pacesetter for a long time, but we are following the rest of the world when it comes to EVs. OEMs are designing for China and Europe, and less so for the United States, which remains a pickup truck market.

One thing that is of course of great interest to retailers is what's the impact of EVs on fixed operations or services, parts and labour etc. I'll go very briefly through why this is a potential problem, and what we're doing about it.

Service, of course, is incredibly important to profits today with a good number of retailers having a gross profit overwhelmingly driven by service. And let’s not forget that it also drives profitability in the future: service satisfaction is a big part of what brings people back to buy a car from dealership again. So, anything to do with fixed operations affects both profit today and profit tomorrow.

We are all worried about research that shows that eventually, over time, in a steady state, EVs will require 40% less maintenance spending and 40% less repair spending. Estimates vary, but it's always along those lines.

The thing is, we have some time to adjust for this, because it comes down by the year 2030; it's maybe 10% of the fleet, not 10% of sales, but 10% of units in operation. We can manage that. But in the near term, we're getting absolutely distorted signals here because we are not seeing any decline at all in service as a result of EVs. Warranty costs tend to be much higher for electric than for petrol or diesel, I'd say. Average dollars per RO from a private dealer group show relentlessly higher repair order totals for EVs than ICE. So data is showing that EVs are coming in more often for service than ICE vehicles.

A lot of this is because they're new vehicles. They're being debugged. We're not yet used to manufacturing them in large numbers. And a lot of this is teething problems that will go away. But at least in the short term, EVs are doing wonders as far as keeping service bays full and profitable.

And if you have a body shop, a collision repair shop, these things are incredibly expensive to repair. So, for the one-third of American dealers which have collision repair, this has been quite a profit driver.

If we go back again to, say, Group 1, in a recently released earnings call, Group 1's analysis shows that they generate more revenue for repair or for vehicles with alternative powertrains, EV and hybrid.

Over time, it should decline as far as EV goes, but not seen it yet. Of course, everyone knows that where you look to here is the Vikings in the north, the Norwegians, which is around 80% EV as new sales. If you do start to see this decline, they sell more tires, sell more collision repair. And emphasise the expertise gap between you and the independents. And consider F&I coverage. This kind of F&I product, for covering EV buyers who are nervous about the battery bursting in the flame etc. should be a big profit source.

I think one of the things that's also going on here is that even as maybe EV powertrain requires less work, we're seeing EVs loaded up with ADAS (Advanced Driver Assistance Systems) etc, and those things are triggering repair. So net-net, we may still not see huge service declines.

The role of the retailer

When demand is greater than supply, you can sell any way you want. You can drop cars from blimps. You can auction them off, raffle them or whatever. It doesn't make a difference. You can pick whatever sales channel you want. When supply is greater than demand, the dealer steps to the fore and since the industry has been in oversupply for the last century or so, in 170 countries around the world, we have the dealership system.

And because dealers solve the problems that OEMs have of either too much production this week or a model that they thought would sell that is not selling well…

So I think we saw a lot of interest in agency when demand exceeded supply in 2020-2022. Now that we're coming back into balance again, we've seen less interest from OEMs in moving into an agency model in the USA.

And the OEMs transitioning are facing a tough learning curve. As one dealer in Sweden phrased it for me on the teething pains of OEMs that do transition to agency, “All I have to do as a dealer to become an agent is forget everything I know. All the OEMs have to do is learn everything I just forgot.”

I think the transition will continue for certain brands. It's not all bad, but rockier and slower than maybe they had hoped, and certainly slower given the change in supply and demand balance.

One thing that does come up a lot in this world that has dealers a little nervous in the United States is Amazon's storefront online for Hyundai. There is a lot of concern about this because who wouldn't be concerned if Amazon entered your marketplace? I think it's probably fine. As one very senior dealer said to me, “I used to advertise in the newspaper, then I moved to radio, I moved to billboards, I moved to the internet. This is just one more way of reaching the customer. We'll be fine.” Maybe that'll turn out to be too optimistic. Of course, throwing a little humour in here, one of the things that Amazon does so well and drives a lot of their growth is their free return policy. We are not quite sure as to how one will return a car to Amazon if you decide you don’t want it!

The Future

My forecast for 2030 then is the same today as it was when I started out in 2016-17 on this project, which is by 2030 the dealership will be “an independently owned company store.” The OEM continues to increase control mostly through back-end IT and incentives and bonuses anyway. So, whether we get agency or not, every year OEM control over our operations increases. The business will remain lucrative, but perhaps less entrepreneurial than we’re used to.