Reading through the news headlines

Recently, there’s been some negative headlines about the current state of the UK car market, with sensationalist headlines stating that we are seeing a dramatic decline in car sales and, as the cost-of-living crisis worsens, consumers are turning away from buying their next car in favour of making other purchases.

To get a clear picture of what’s going on in the market and whether there is any truth in these headlines, we’re sharing exactly what our data is telling us and how this compares to five negative headlines that we’ve seen in recent weeks.

Headline 1: Used car demand is falling

It’s true that we have seen a recent softening in demand when compared to the same period in 2021. However, as many of you will know, 2021 was an exceptionally strong year. Despite this, advert views have remained at approx. 90% of 2021 levels.

When we compare to the last year of “normal” trading conditions, 2019, we can see that demand remains very strong with both site visits and advert view volumes significantly higher.

It’s also worth noting that there are factors that could see growth in demand, with the half a million people waiting for a driving test and people no longer relying on public transport potential sources of new demand.

Headline 2: Used car sales are falling

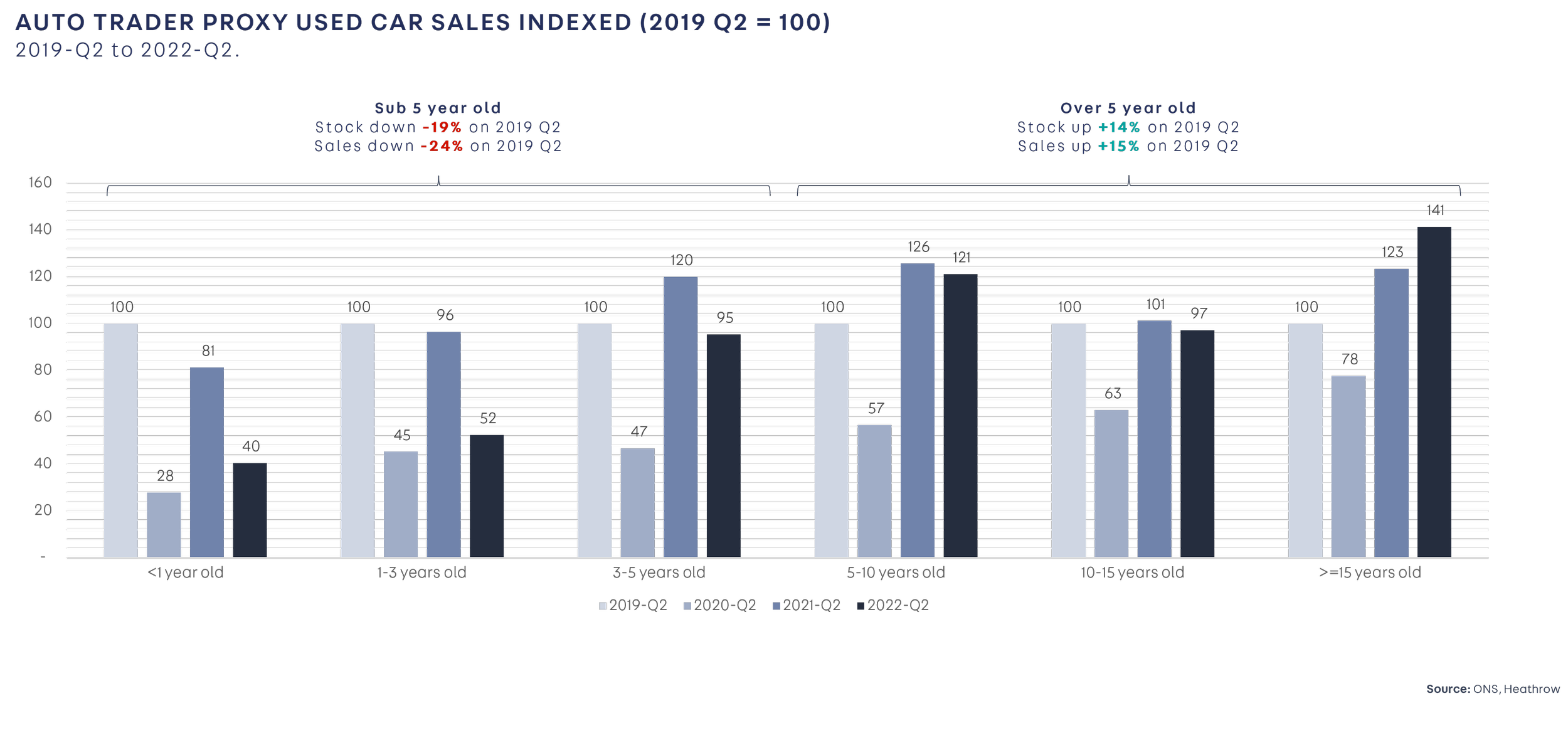

Total used car sales have fallen 18% on last year and remain 13% behind 2019 levels according to data from the Society of Motor Manufacturers and Traders (SMMT). We’ve seen a similar trend on Auto Trader based on the volumes of stock removed.

However, this is not the results of declining demand, rather this is continuing supply shortage stifling sales as sales are healthy within age cohorts where stock is available.

Headline 3: Used car values are falling

In short, there are no signs of any significant drops in used car values and we certainly see no signs of a “cliff edge” drop in prices any time soon. We continually monitor average used car prices based on the vehicles on our site and we are currently seeing price movements in line with seasonal patterns.

Headline 4: Consumers are trading down to cheaper cars

We’ve seen no evidence of this on our platform, with little change in the ad view mix across price points. Consumers then seem to be continuing to look at cars in the same price brackets as they did last year. However, whilst they are looking in the same brackets, the vehicles they are looking at in these brackets will be older/higher mileage given the price increases we have seen in the last year.

Headline 5: Consumers are prioritising holidays over cars

The lifting of lockdowns has seen an increase in the volume of flights. However, there are no signs that holidays are being prioritised by households with flight and passenger volumes still below pre-pandemic levels by around 18%.

How to perform well in a challenging market

The market then does remain strong but there are certainly challenges ahead. We’d therefore recommend you follow these six simple steps to ensure your continued success through 2022:

Be brilliant at the basics – focus on your digital forecourt as closely as your physical forecourt

Optimise days to sell – adjust your sourcing and pricing strategy

Extend your reach – be where the buyers are

Maximise the margin opportunity on each vehicle

Make the most of all the tools available to you

Stay on top of the latest market movements