What did we learn at the Auto Trader New Car Awards 2022?

Last week we announced the winners of the Auto Trader New Car Awards 2022, our annual celebration of the very best new cars on offer right now as chosen by the people who matter most, their owners.

Over 156,500 owners took part in this year’s survey, telling us exactly what they think of their car and how well it suits their lifestyle. We shared some of what we found along with our latest new car market insights at last week’s awards, and you can read some of the highlights right here.

The awards were presented by our Editorial Director, Erin Baker and You Tube Director Rory Reid

You can discover the full list of winners at this year’s awards by clicking here.

The demand is still there

It’s been a tough few year for the new car market. With the pandemic, chip shortage and now war in Ukraine all hampering the available supply of new cars to the market.

But whilst, supply may be hampered, buyer demand for new cars is anything but. Right now, on our marketplace we’re seeing 200,000 daily views of new cars and 1,000 new car leads being sent to retailers.

Leads on new cars were up 56% on the previous year (May 21-May 22 vs May 20-May 21), despite cars often being sold as they find their way into the country.

So demand remains healthy and as supply recovers we can expect that there will be eager buyers waiting to snap up their new car.

What buyers are looking at is changing

Whilst the focus of the Auto Trader New Car Awards has always been on new cars (as the name somewhat suggests), it’s hard to ignore the used cars given the exceptionally strong demand we’ve seen in the market. In fact, nine in ten new car considerers on our marketplace also look at a used car. To a lesser extent this is also true for used car buyers, with one in four also considering a new car.

It would therefore seem that the traditional new and used car buyer buckets are not so clean cut, with supply constraints forcing buyers to broaden their search for their next car.

This broader search also applies to the number of brands new car buyers are looking at through their buying journey. Buyers are now looking at 12.3 brands on average, up from 11.6 last year, and even the shortest lists – those considering premium German marques - have 9 brands on them.

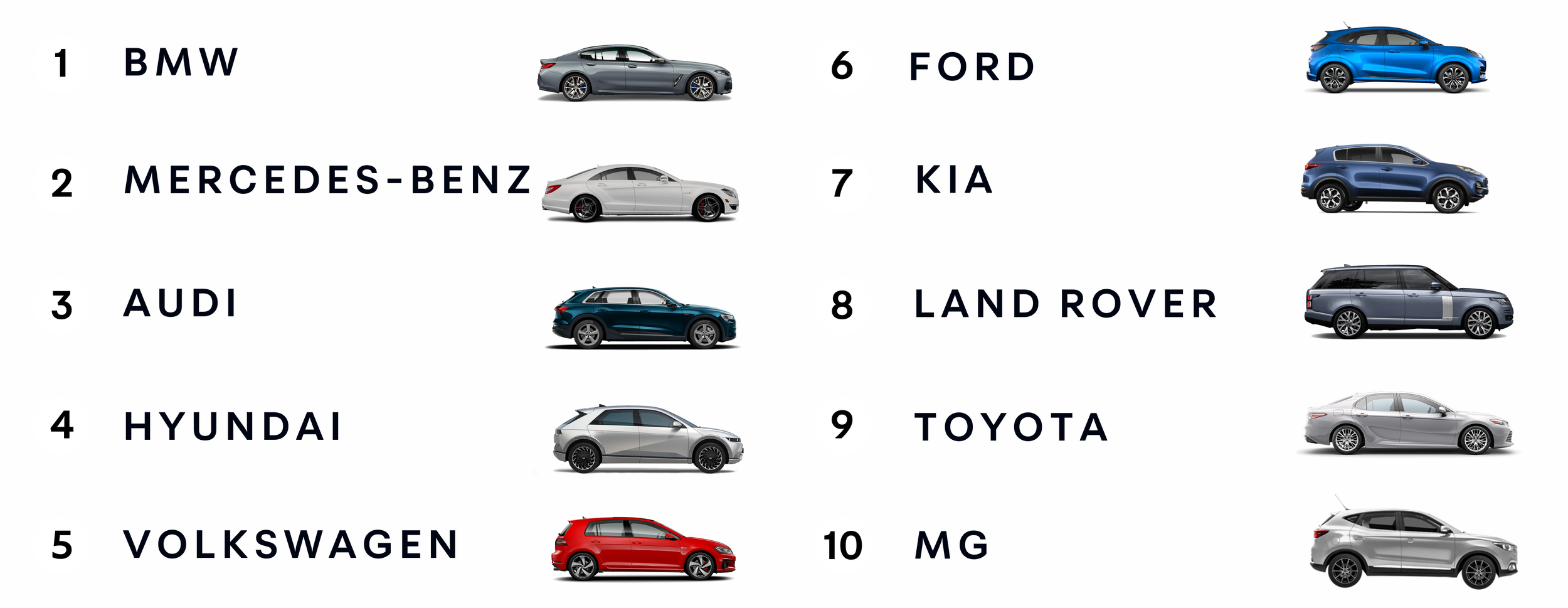

Below you can see the top ten most popular new car brands by advert view on our marketplace.

The successful launch of desirable electric vehicles by Hyundai and Kia in the last year have seen them enter the list for the first time.

We’ve also found that the average new car buyer is looking across body types and fuel types. 75% of SUV considerers also look at hatchbacks and 64% of those preferring a hatchback have SUVs on the list, too. 20% of both petrol and diesel considerers are also looking at electric cars, and for hybrid considerers it’s over 40%.

Buyer behaviour is incredibly fluid and that labelling them as one type of buyer or another type is almost impossible. A more fluid approach to targeting, tracking, and measuring is long overdue.

Owners love their electric cars

This year’s awards saw the all-electric Polestar 2 crowned as the winner of the New Car of the Year award as voted for by owners. But the love for electric didn’t stop there with electric vehicles taking the top spot in nine awards at last week’s event.

In fact, 83% of electric vehicles owners in our survey stated that they really love their car, more than owners of any of the other fuel types.

This adoration of electric vehicles is also seen on our marketplace with one in five new car advert views now for an electric car and around 25% of all new car leads sent to retailers now for an electric vehicle.

And, as more people start to consider an electric vehicle and more models become available, we have seen a shift in brand considerations. Buyers who historically would have considered themselves premium brand people are now considering – and enquiring about – electric cars from Kia, Hyundai, Ford, Vauxhall and MG

Last year views of premium brand cars took 58% of new car views, but this year that’s dropped to 46%, with much of the change down to how brands like these have captured electric car considerers.

Over a quarter of new car buyers look at MG, one in three now have Kia and Hyundai on their lists and nearly half of all electric vehicle considerers check out a Tesla.

So not only is electric car interest growing, but it’s changing the brands people look at.