What's the impact of low consumer confidence on the bike market?

Once again, we are seeing world events having an impact on many markets, recently the increased cost of living and the war in Ukraine means consumer demand is being impacted. The GfK consumer confidence index continues to drop as the cost of living continues to rise, now at -31 in March 2022 (down from -26 in February), the lowest it has been since Nov 20.

However, this drop is much more dramatic than the confidence we’ve seen on-site, where despite wider concerns over the economy, we've seen over 115,000 daily cross platform visits to Auto Trader Bikes.1

In January, we launched our Market Insight tool to bike retailers, giving an unrivalled view of the live retail market, which when combined with dealer’s retailing expertise, helps them to stay one step ahead by arming them with powerful data-led insight.

Looking at the latest 13-week period, we can see that currently buyer demand for petrol bikes is down at –4%. Although demand grew steadily from w/c 21st February, reaching a peak of a positive 4%, it then dropped from w/c 21st March. This is of course a year-on-year comparison, and in 2021, there was a vastly different environment; the UK was emerging from another lockdown and many travel restrictions were still in place.

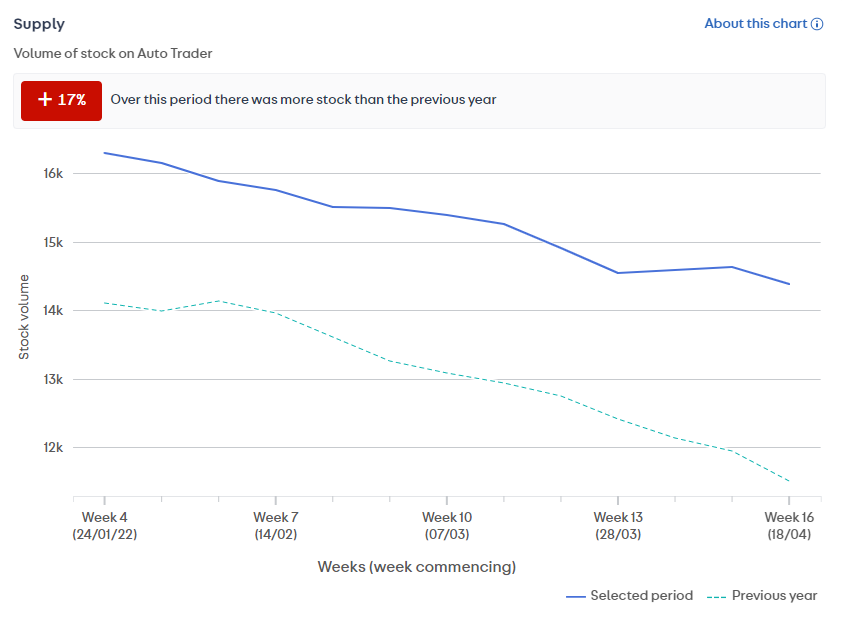

The supply outlook is positive, at +17%, meaning more bikes are coming into the market and available to buy, driving an overall Market Health of -18%. 2

Even so, the like-for-like prices remain strong and the price growth for petrol bikes is up 6% YoY during the same 13-week period.

Our latest data suggests the average price of a used bike on Auto Trader grew 6% in March year-on year, now at £7,592, marking yet another month of consecutive year-on-year price growth.3

When we compare this to Electric bikes however, we can see the positive effect of the growing popularity for alternatively fueled vehicles as bike buyers consider what fuel price rises could mean for them. Watch out for more details on electric demand soon.

Your competitive advantage awaits

Keep your business empowered and ahead of your competitors by discovering this insight for yourself. Analyse the data available to inform operational and marketing decisions for your forecourt, plan your future stock mix and maximise the opportunities to retain and grow margins.

It's completely free and part of your package - check it out today by visiting Portal and head to the Analytics tab.

1 Average daily sessions, Auto Trader Bikes, 18th-24th April 2022

2 Auto Trader Market Insight data, Comparing Mon 24 Jan 2022 - Sun 24 Apr 2022 vs Mon 25 Jan 2021 - Sun 25 Apr 2021

3 Auto Trader internal data, March 2022