Do Older, Cheaper Vehicles sell on Auto Trader?

In the ever-evolving landscape of the UK automotive market, retailers need to adapt their strategies to stay competitive and profitable. Recent data from our platform highlights a compelling case for broadening the mix of vehicles on retailer forecourts, particularly by focusing on older, cheaper cars. With shifts in demand, supply constraints, and changing consumer preferences, there is a compelling argument for why stocking these vehicles can be a smart move.

By 2026, the number of under-five-year-old cars in the parc is projected to drop by nearly three million

The Impact of Supply Constraints

The dynamics within the Car Parc have been relatively stable over the years, but the pandemic has caused a seismic shift. The disruption in new car sales from 2020 to 2023 led to 2.4 million "lost" new car sales, creating a ripple effect that will be felt for years. By 2026, the number of under-five-year-old cars in the parc is projected to drop by nearly three million, leaving retailers with a significantly smaller pool of newer vehicles.

For those specialising in younger stock, this presents a substantial challenge. However, it also opens an opportunity to diversify inventory by incorporating older vehicles. With fewer new cars entering the market, older vehicles will become an increasingly important part of the used car landscape.

Retailers who adapt to this reality by broadening their mix will be better positioned to meet future demand.

The Appeal of Older Vehicles: Breaking the Myth

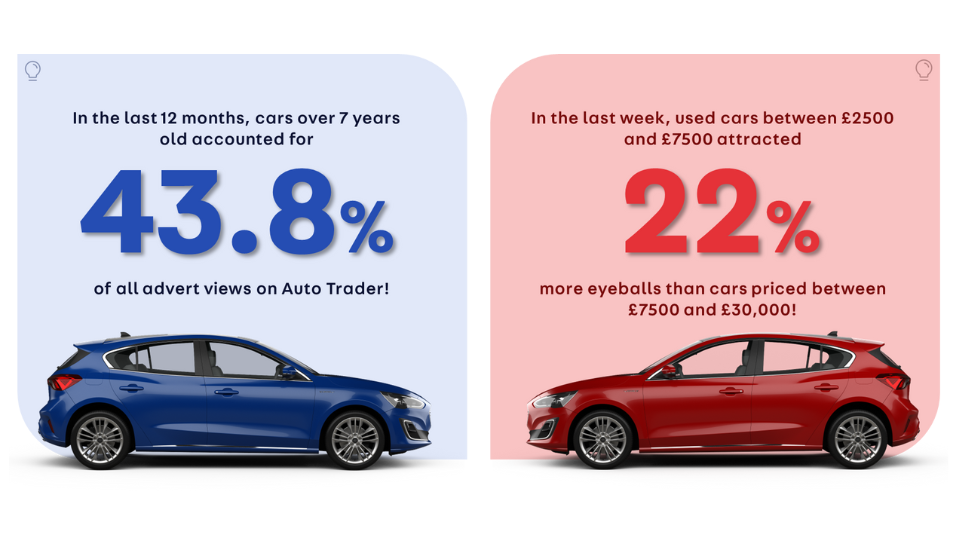

A common misconception among retailers is that Auto Trader's audience is primarily interested in newer vehicles. However, data shows that older stock performs just as well, if not better, than younger stock. In fact, cars over seven years old accounted for 43.8% of all advert views on Auto Trader in the last 12 months. This challenges the assumption that only newer cars attract attention.

Moreover, used cars priced between £2,500 and £7,500 have seen a 22% increase in views compared to those priced between £7,500 and £30,000. Not only are these lower-priced vehicles attracting more eyeballs, but they also have a faster average national days to sell. This trend underscores the value of stocking older, cheaper vehicles that appeal to a broad range of budget-conscious buyers.

Demand Outpacing Supply

Recent figures reveal that demand for 5-10 year old vehicles on Auto Trader over the last 4 weeks has increased by 5.6% year-on-year (YOY), nearly double the growth seen in the previous period. In contrast, supply has decreased by 2.8% (YOY). The key metric of Market Health, which compares the ratio of demand to supply, stands at a positive 8.79%. For retailers, this means that there is a growing opportunity to meet the increasing demand, but with a shrinking pool of newer vehicles, older vehicles are becoming more appealing. With 1.5 million daily users on Auto Trader in the last week alone, the market remains vibrant, yet the pressure on supply continues to build.

Profitability of Cheaper Stock: A Closer Look

Data from Dealer Auction further supports the case for older, cheaper vehicles. Around 28% of all vehicles available on their platform are priced under £7,000, with an average estimated gross profit of £2,185. This level of profitability is significant for retailers, especially when considering the faster turnaround time for these vehicles. By leveraging this data, retailers can make informed decisions about the types of vehicles to stock, ensuring a healthy balance between demand and profitability.

Retailers have access to powerful tools like Auto Trader’s Market Insight, which allows them to track price trends and identify areas of the market with strong demand. By blending historic market data with live vehicle data, and filtering this information relative to their specific forecourt and consumer type, retailers can stay ahead of the curve.

The ability to adapt to changing market conditions by stocking a diverse range of vehicles—including older, cheaper options—will be crucial for maintaining a competitive edge. This data-driven approach ensures that retailers can confidently navigate market fluctuations and continue to meet the needs of their customers.

Embracing the Shift

The automotive market is undergoing significant changes, and retailers must adapt to thrive. The data clearly shows that older, cheaper vehicles are not only in demand but also offer strong profitability. By broadening the mix of vehicles on their forecourts, retailers can tap into this growing market segment, meet customer needs, and maintain a healthy bottom line.

As the supply of newer vehicles continues to shrink, the importance of older stock will only increase. Retailers who recognise this trend and adjust their inventory accordingly will be well-positioned to succeed in the evolving automotive landscape.

Are you considering how can you and your team can capitalise on these trends? In a recent webinar we explored “Which Vehicles Sell Best on Auto Trader” - diving into the strategies that are driving sales on Auto Trader. Our team provide insights into the top-performing vehicles and strategies to enhance profits through a diverse stock mix.